Ben Sklar / Stringer/Getty Images

- An increase in the capital gains tax rate probably won't impact the stock markets, according to experts.

- There may be momentary impacts on the market, a UBS note said, but likely no lasting impacts.

- America's wealthiest are reportedly scrambling to move their money around anyway.

- See more stories on Insider's business page.

A Biden tax proposal sent a jolt through markets last week – and through wealthy Americans.

The White House is on the case, addressing the tax's impact in a briefing yesterday. National Economic Council Director Brian Deese insisted in the briefing that it will touch very few Americans, and that the market has little to fear.

"Across a wide body of academic and empirical evidence, there is no evidence of a significant impact of capital gains rates on the level of long-term investment in the economy," Deese said.

President Joe Biden wants to raise taxes on America's wealthy to pay for the care-focused part of his infrastructure package, which will focus on childcare and education.

But Biden doesn't want an outright wealth tax like that proposed by progressives; instead, he's made various proposals including nearly doubling the capital gains rate for Americans who make over $1 million a year. The proposed increase will only impact about 0.3% of tax filers, Deese said.

Profits from capital gains - assets like stocks - are currently taxed at a lower rate than income, with gains on assets that are held for over a year being taxed at around 15% to 20%. Under Biden's plan, the rate would climb to 39.6% alongside a 3.8% Obamacare tax, bringing the total rate to around 43.4%.

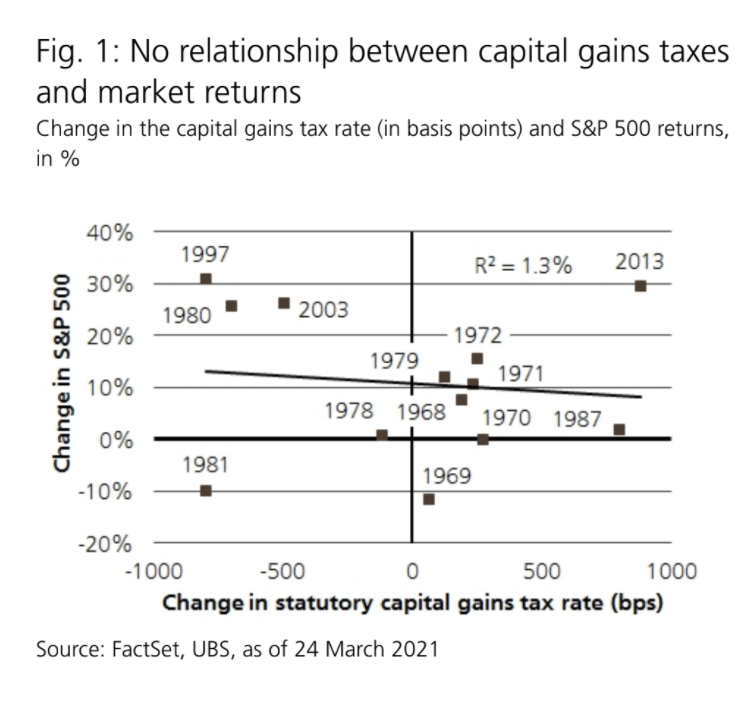

A note from UBS Global Wealth Management aligned with Deese's remarks. "History shows no relationship between capital gains tax rate changes and stock market performance," a team led by Solita Marcelli, chief investment officer for the Americas, wrote.

The note also observes that only about a quarter of the US stock market would fall under this tax and the other 75% is owned in accounts not subject to capital gains taxes, such as retirement accounts, endowments, and foreign investors.

UBS GWM

David Lefkowitz, the head of Americas equities at UBS Global Wealth Management, told Insider that while we could "certainly" see days like Thursday again - where stocks tumbled following reporting on the capital gains tax rate increase - there could be a small downside impact, but no real lasting impact.

"Obviously, you could have implications for individual investors," Lefkowitz said, noting that depends on people's specific tax situations. But, he added, "In terms of the impact on the market overall, we really don't think there's going to be any long lasting impact."

Even still, some wealthy Americans are panicked at the thoughts of capital gains taxes rising. Reuters reports that wealth advisers are advising clients on the best ways to move around their money to avoid the potential capital gains hike. That includes measures like selling off assets and maxing out retirement contributions.

And, as Bloomberg reports, the taxpayers who will feel the impact of Biden's tax package the most will are those who live off investments. Some of the ultra-wealthy are in a "scramble" to move assets, and some are considering selling them off. That comes as Biden looks to direct $80 billion to the IRS in an effort to get back unpaid taxes from the rich.

In his briefing, Deese noted that the typical American's income comes primarily from wages, not investment. The opposite is true for the wealthiest Americans. That means their tax rates are lower.

So, when it comes to the proposed increase, Deese said: "We believe that it's not only fair, but it would also help to reduce the kinds of tax avoidance that significantly undermines trust and fairness in the tax code itself."

For what it's worth, Marcelli's team noted that investors with a high level of taxable income may be able to work with financial and tax advisors to reduce it below the $1 million level, maybe by allocating more to municipal bonds instead of corporate bonds, by making more charitable contributions, or by receiving dividend income instead of a salary from business interests. The New York Times reported today that Biden will also seek to raise the tax rate on stock dividends for those earning over $1 million a year, citing a person familiar with the proposal.